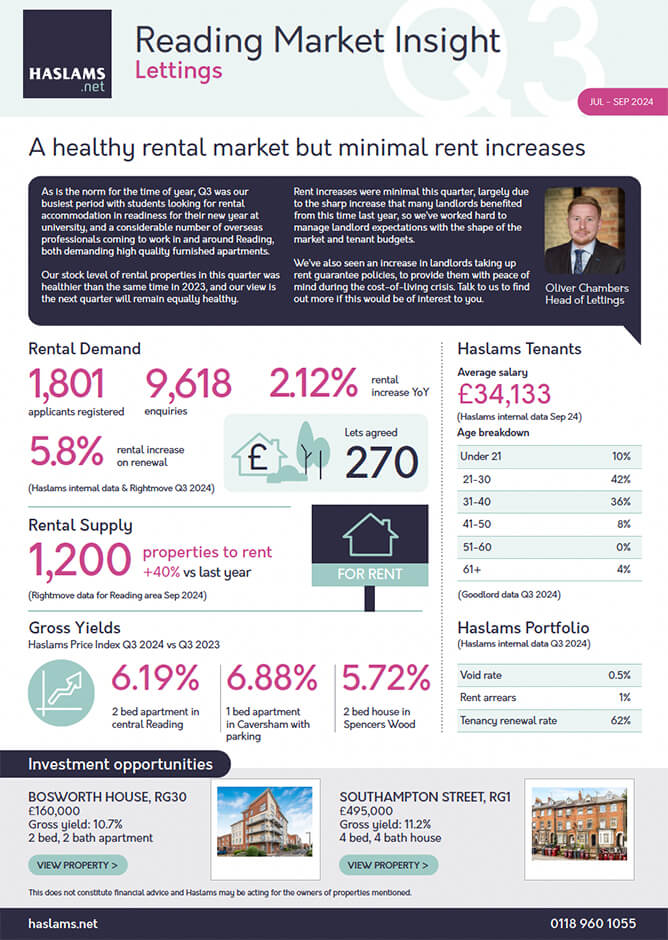

A healthy rental market but minimal rent increases

As is the norm for the time of year, Q3 was our busiest period with students looking for rental accommodation in readiness for their new year at university, and a considerable number of overseas professionals coming to work in and around Reading, both demanding high quality furnished apartments.

Our stock level of rental properties in this quarter was healthier than the same time in 2023, and our view is the next quarter will remain equally healthy and busy.

Rent increases were minimal this quarter, largely due to the sharp increase that many landlords benefited from this time last year, so we’ve worked hard to manage landlord expectations with the shape of the market and tenant budgets. We’ve also seen an increase in landlords taking up rent guarantee policies, to provide them with peace of mind during the cost-of-living crisis. Talk to us to find out more if this would be of interest to you.

View our Residential Sales report here.

|

Oliver Chambers Head of Lettings Sales |

Rental Demand

applicants registered

enquiries

rental increase YoY

rental increase on renewal

lets agreed

(Haslams internal data & Rightmove Q3 2024)

Rental Supply

properties to rent

vs last year

(Rightmove data for Reading area Jul-Sep 2024)

Gross Yields

2 bed apartment in central Reading

1 bed apartment in Caversham with parking

2 bed house in Spencers Wood

(Haslams Price Index Q3 2024 vs Q3 2023)

Haslams Tenants

Average salary

(Haslams internal data 09/24)

| Age Breakdown | |

|---|---|

| Under 21 | 10% |

| 21-30 | 42% |

| 31-40 | 36% |

| 41-50 | 8% |

| 51-60 | 0% |

| 61+ | 4% |

(Goodlord data Q3 2024)

Haslams Portfolio

(Haslams internal data Q3 2024)

| Void rate | 0.5% |

| Rent arrears | 1% |

| Tenancy renewal rate | 62% |

Investment opportunities

Bosworth House, RG30

£160,000 10.7% yield

2 bed, 2 bath apartment

View property >

Southampton Street, RG1

£495,000 11.2% yield

4 bed, 4 bath house

View property >

This does not constitute financial advice and Haslams may be acting for the owners of properties mentioned.

Download Haslams Q3 2024 Lettings Report as a PDF