Rental market remains strong despite policy reforms

2025 has started off strong at Haslams Lettings. Applicant flow is good and let volumes are noticeably up year on year. Rental values have dipped slightly due to more stock in the market, largely where tenants have served notice, but properties are still being let quickly thus incurring minimal void periods. And rents are still up 10 to 15% on where we were in 2022.

With the Renters’ Rights Bill currently going through Parliament, Haslams is keeping on top of what this will mean for landlords. We believe that landlords who stay in the market and follow best practices and recommendations will continue to benefit from consistent rental income and good return on investment.

We have a considerable number of landlords who have taken out Rent Guarantee insurance, due to the proposed eviction notice period for rental arrears changing from two months to four months as part of the Renters’ Rights Bill. Please get in touch if you would like to find out more and protect yourself against potential rent arrears.

Read our Residential Sales report here or scroll down to continue to read our Lettings report.

|

Oliver Chambers Head of Lettings Sales |

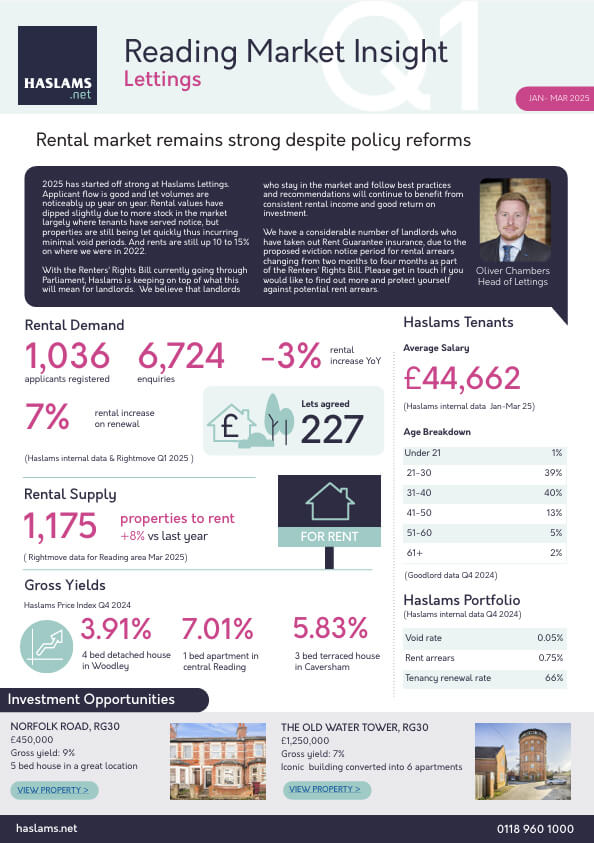

Rental Demand

applicants registered

enquiries

rental increase YoY

rental increase on renewal

lets agreed

(Haslams internal data & Rightmove Q1 2025)

Rental Supply

properties to rent

vs last year

(Rightmove data for Reading area Mar 2025)

Gross Yields

4 bed detached house in Woodley

1 apartment in central Reading

3 bed terraced house in Caversham

(Haslams Price Index Q1 2025)

Haslams Tenants

Average salary

(Haslams internal data Jan-Mar 25)

| Age Breakdown | |

|---|---|

| Under 21 | 1% |

| 21-30 | 39% |

| 31-40 | 40% |

| 41-50 | 13% |

| 51-60 | 5% |

| 61+ | 2% |

(Goodlord data Q4 2024)

Haslams Portfolio

(Haslams internal data Q1 2025)

| Void rate | 0.05% |

| Rent arrears | 0.75% |

| Tenancy renewal rate | 63% |

Investment opportunities

Norfolk Road, RG30

£450,000

Gross yield: 9%

5 bed house in a great location

View property >

The Old Water Tower, RG30

£1,250,000

Gross yield: 7%

Iconic building converted into 6 apartments

View property >

This does not constitute financial advice and Haslams may be acting for the owners of properties mentioned.