How has the housing market performed?

The first quarter of 2021 has been an exciting time for most people in the UK. The tangible optimism heralded by lifting of restrictions and people reconnecting with friends and family, whilst being able to enjoy leisure activities, shopping or eating out, is generating new momentum within the economy.

The Spring Budget in March was a turning point for many people who were considering a move. Haslams data demonstrated a 25% increase in the number of direct enquiries, after the announcement, which we believe to be a direct result of the Stamp Duty Holiday and government mortgage guarantee.

As predicted, the figures from the Haslams Market Intelligence Database (1) shows a slight decrease in the value and volume of apartment reservations both within the New Build and residential sales, which coincides with data that suggests property seekers desire more outside space and an area to work from home. This is confirmed by premium developments which meet these requirements, as we have observed no reduction in reservations and they have exceeded the sales value benchmarks held in Reading.

Our data shows New Build apartments in the area currently have an average achieved price of £300,227, which is a 2.9% decrease from last year and for non-New Build the average is £198,521 and a 3.5% decrease within the same period. The current outlook for houses is more positive. The asking price for houses has increased by an overall average of 3.5%.

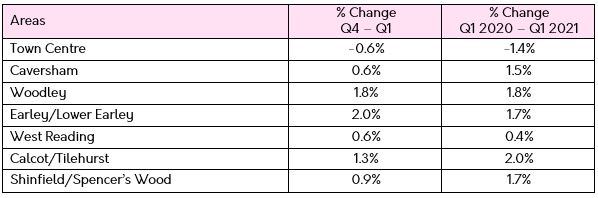

The Haslams House Price Index (2) indicates the areas experiencing most property price inflation in Q1 were Calcot/Tilehurst (2%) and Woodley (1.8%). However the best performing property types were 3 bedroom houses in Earley (5%) and also 3 and 4 bedroom houses in Woodley (4% each).

(Source: Haslams House Price Index)

How does this compare to the same time last year?

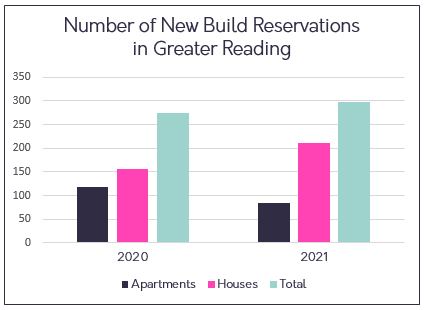

We have seen a positive change for two years in a row during the first quarter of both years. From a New Build perspective our data demonstrated a 6.15% increase in total reservations from Q1 2020 to the same period this year. This meant that the average number of reservations for Q1 in 2021 was 6.3 units per site.

(Source: Haslams Market Intelligence)

Although the circumstances were very different, at the end of 2019 the property market had been somewhat dampened by concerns around Brexit and the economy whereas at the start of 2021 we were finally seeing the light at the end of the tunnel in respect of Coronavirus – in both cases the effect on the market was very similar. Residents in and around Reading had a strong desire to move home but up until the first quarter of each year, were facing levels of uncertainty.

Our residential sales team has also reported a record number of property enquiries for one desirable family property and a high number of overall viewing requests, demonstrating strong interest for available properties and we have received a significant number of Buy to Let Investors making further acquisitions. Overall, the current supply does not meet the level of demand for purchasers, suggesting it is a good time for people to consider selling their property and moving on.

Overall demand can also be represented by the levels of discount for New Build apartment and house sales in 2021 which was significantly lower compared to the previous period, having decreased by 1.2%. The more demand there is, the less that developers were inclined to offer incentives or discount.

What are the predictions for Q2 – Q4?

The buyer demand for houses and premium apartments at the beginning of Q2 is already at a high. The spring and early summer are traditionally times when parents are considering a move for their children’s future or current school catchment. On top of this typical activity, we have already seen momentum from the Stamp Duty holiday and the access to more favourable mortgage options for first time buyers. With more affordable options, the property market may continue to go from strength to strength within a period of growth, over the next few years.

In the property market we are yet to realise any potential long term damage that coronavirus has had on the economy. As a result of the current high levels of activity we would expect property prices to increase, at least in the short term, if the supply doesn’t match the availability. According to many data reports, the current market conditions have created one of the best sellers’ market of the past 10 years.

If your ready to take the next step, take a look at our latest properties for sale or get ready to sell your home with Haslams Estate Agents.

1. The Haslams Market Intelligence Database, one of the most powerful new homes databases anywhere in the UK, holding more than 20 years of sales data on all new build developments in Greater Reading.

2. The Haslams House Price Index, the only property price index dedicated to Reading, based on an index of sample of house types that are valued quarterly.