The Reading sales market has more life than you might think

The national headlines across the UK state that house prices have decreased roughly 5% and transactions are down 20% 1. Yet we have actually agreed 17% more sales in Reading during Q3 this year against 2022! The Reading market is buoyed up by first-time buyers and cash investors, including the tenants at the property in Kennet House who decided to buy the home they were renting.

Kennet House, Reading

In this deal the motivating factor was to turn rent payments into mortgage payments. The Haslams Price Index puts house prices down by 1% year-on-year in wider Reading area.

Within that -1% figure are lots of stories. Figure 2 shows a HMO listed at £390K near the University with tenants in situ, the same price as an identical house we sold for the same vendor 6 months earlier. In fact the final sale agreed at a 10% reduction which reflects the increased borrowing costs for an investor and the desire to maintain a reasonable yield.

Within that -1% figure are lots of stories. Figure 2 shows a HMO listed at £390K near the University with tenants in situ, the same price as an identical house we sold for the same vendor 6 months earlier. In fact the final sale agreed at a 10% reduction which reflects the increased borrowing costs for an investor and the desire to maintain a reasonable yield.

A more selective market in Wokingham and Crowthorne

In Wokingham transactions are down 20% in Q3, in line with the national figure. Case Study 1 tells quite a story and is illustrative of current demand for family houses. With higher mortgage rates you see fewer discretionary movers and agents must roll up their sleeves and put the hours in to reassure buyers and sellers. We worked hard to keep this deal alive and it represents success relative to market conditions.In Crowthorne there is more signs of life with transactions down 8% relative to Q3 in 2022. Case Study 2 is a good representation of market conditions: you cannot rely on the property portals to sell homes. The real work for agents often starts once a property goes under offer.

Case Study 1 – The Cottage

We were instructed at £1 million in June. An offer came in of £925,000 from buyers with a house to sell. The buyers put their property on the market, and we continued to market the Cottage. With little interest the Cottage was reduced to £935,000. After some weeks, the person who offered £925,000 finally sold his property for £170,000 less than it was originally marketed for and returned with an offer of £850,000 which the owners have accepted.

Case Study 2 – Crowthorne

We agreed a sale in March only for the buyer to withdraw in June in a softer market. We started again and lateral thinking led us to match the property with the eventual new buyer. There were multiple hurdles to overcome including servicing and certifying a wood burner, a boiler service, and the removal of a large dead tree which was leaning precariously towards the neighbour’s property

Rental demand remains red hot with increases of up to 16% annually

The rental market remains in unprecedented territory with a minor reduction in stock and an increase in demand, leading to an imbalance which is difficult for many tenants to navigate.

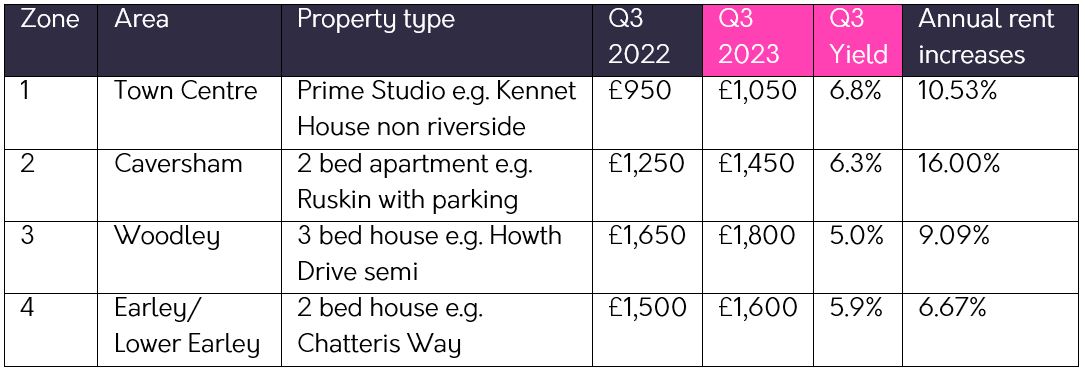

The table shows some illustrative rents across Wider Reading and the increase from Q3 in 2022 to Q3 this year. The Reading economy shows no sign of stalling and the volume of high quality overseas tenants who contact us is consistent.

Selection of rental properties and areas in Wider Reading

Yields above 6% are normal now

The table illustrates that gross yields (the annual return on the total sum invested in buying the property) are often above 6% in Reading now. This is due to sales prices plateauing and rents increasing. We do not see many novice buy-to-let investors with mortgage rates so high but the ‘professional’ investors are being spurred into action by these climbing yields.

We have let 70% more homes in Reading than the number 2 agent 2

This is self-promotion, we realise, but we have worked hard for it. As the market leader, demand can be so strong that we list a property only for a few hours before removing it from the property portals. We try to balance the integrity of helping each prospective tenant with our duty to the landlords and this market makes it very difficult to avoid disappointing tenants.

The EPC changes are cancelled – or should we say ‘delayed’?

Rishi Sunak stunned the rental industry in September by scrapping proposed changes to make the minimum EPC rating ‘C’ by 2025 (or 2028, nobody was sure). It is now ‘E’. In fact the proposals had never been published, just leaked to the media at various points by the Government. But now: no change required and some landlords will be grateful. However our view is that Labour would introduce some form of energy efficiency improvements into the industry. We just hope it is accompanied by robust incentives & grants.

If you would like to discuss any of the matters in this report, please get in touch on 0118 960 1000 or email sales@haslams.net

1 Nationwide Index 2/10/23 and TwentyCI

2 Rightmove Plus data 1/7/23 to 27/09/23 for 21 Reading postcodes